NAF has launched a petition on Change.org calling on the FDA to prioritize treatment options for rare diseases with urgent unmet needs, including Spinocerebellar Ataxia (SCA).

SIGN THE PETITION

NAF has launched a petition on Change.org calling on the FDA to prioritize treatment options for rare diseases with urgent unmet needs, including Spinocerebellar Ataxia (SCA).

SIGN THE PETITION

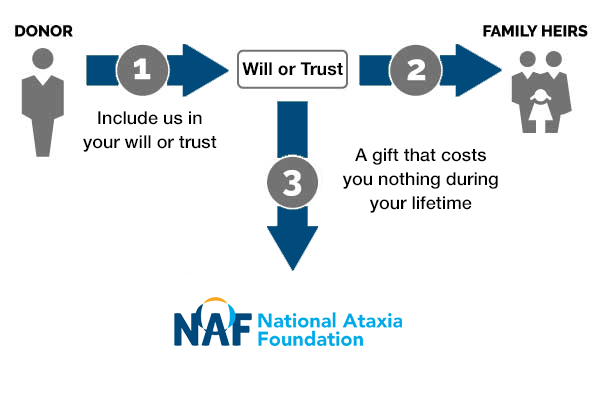

Gifts in a will or by beneficiary designation are two easy ways to improve the lives of those living with Ataxia for years to come — and they don’t cost anything now.

Making a legacy gift in your will or trust is one of the easiest and most popular ways to make a lasting impact for the National Ataxia Foundation. Once you have provided for your loved ones, we hope you will consider making working towards a cure for Ataxia part of your life story through a legacy gift.

Your gift will create your legacy of uplifting the Ataxia community.

You can alter your gift or change your mind at any time and for any reason.

Costs you nothing now to give in this way.

Check out your options below. You can mix these no-cost ways together. For example, you might consider leaving a specific percentage (such as 50%) of the residual to the National Ataxia Foundation contingent upon the survival of your spouse.

A general bequest is a gift of a specific amount.

A residuary gift is a gift of all or a percentage of the remainder of your estate after specific bequests and expenses have been paid.

A specific gift is a gift of a particular piece of property. For example, real estate, funds in a bank account or shares of a corporation.

A contingent gift takes effect only if the primary beneficiary or beneficiaries do not live longer than you. In other words, your gift is contingent upon whether or not they survive after you.

Please let us know if you’ve included a gift for the National Ataxia Foundation in your will or through a beneficiary designation. Providing us with documentation is the best way to ensure that your gift is used in the way you intend.

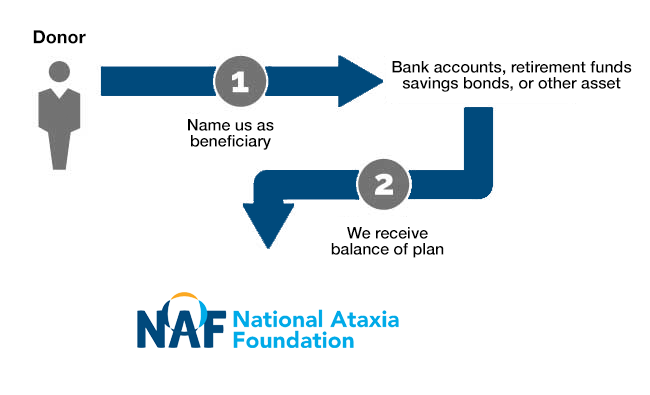

It’s easy to put your bank accounts, retirement funds, savings bonds, and more to use in promoting exchanges of ideas and innovation in Ataxia discovery — and it costs you nothing now.

By naming the National Ataxia Foundation as a beneficiary of these assets, you can power our mission for years to come and establish your personal legacy of helping to achieve our vision of a world without Ataxia.

Reduce or eliminate taxes

Reduce or avoid probate fees

No cost to you now

Create your legacy with NAF

Check out your options for beneficiary designations below.

You can simply name the National Ataxia Foundation as a beneficiary of your retirement plan to provide a better quality of life for people with Ataxia.

You can name the National Ataxia Foundation as a beneficiary of all or a portion of your life insurance policy. With this gift arrangement, NAF will receive the proceeds of your policy after your lifetime. You can change your beneficiary at any time and may reduce your estate taxes.

This is one of the easiest gifts to give and one of the most useful in accomplishing your philanthropic goals. The next time you visit your bank, you can name the National Ataxia Foundation (Tax ID:41-0832903) as the beneficiary of a checking or savings bank account, a certificate of deposit (CD), or a brokerage account. When you do, you’ll take a powerful step toward eliminating Ataxia for future generations.

What remains in a donor-advised fund is governed by the contract you completed when you created your fund. When you name the National Ataxia Foundation as a “successor” of your account or a portion of your account value, you enable vital programs and services for Ataxia families.

Check out your options below. You can mix these no-cost ways together. For example, you might consider leaving a specific percentage (such as 50%) of the residual to the National Ataxia Foundation contingent upon the survival of your spouse.

Please let us know if you’ve included a gift for the National Ataxia Foundation in your will or through a beneficiary designation. Providing us with documentation is the best way to ensure that your gift is used in the way you intend.

Our experienced team is here to help you…

Jon Wegman

Development Manager

jon@ataxia.org

763-231-2747

During your lifetime, you can recommend a grant from your donor-advised fund to support Ataxia families through the National Ataxia Foundation. You may choose to make a one-time gift, or to create a recurring monthly or quarterly gift for even more impact.

——————-

Legal name: National Ataxia Foundation

Address: 600 Highway 169 South, Suite 1725, Minneapolis, MN 55426

Federal Tax ID number: 41-0832903

* Please note our mailing address is: 7701 Golden Valley Road, PO Box 27986, Golden Valley, MN 55427

The following language may help you and your attorney when drawing up a bequest that meets your needs.

“I give to the National Ataxia Foundation, a nonprofit corporation currently located at 7701 Golden Valley Rd, PO Box 27986, Golden Valley, MN 55427, or its successor thereto, ______________* [written amount or percentage of the estate or description of property] for its unrestricted use and purpose.”

——————-

*If you are interested in supporting a specific project or program, it is best to discuss your plans with our planned giving professionals before completing your bequest language to confirm your wishes can be met by NAF.

Please note: The policies of the National Ataxia Foundation do not allow NAF or its representatives to serve as personal representative, executor, trustee or witness for a will or trust.

——————-

Legal name: National Ataxia Foundation

Address: 600 Highway 169 South, Suite 1725, Minneapolis, MN 55426

Federal Tax ID number: 41-0832903

* Please note our mailing address is: 7701 Golden Valley Road, PO Box 27986, Golden Valley, MN 55427

To designate NAF as a beneficiary of a qualified retirement plan or other financial account, please use the following information:

Legal name: National Ataxia Foundation

Address: 600 Highway 169 South, Suite 1725, Minneapolis, MN 55426

Federal Tax ID number: 41-0832903

* Please note our mailing address is: 7701 Golden Valley Road, PO Box 27986, Golden Valley, MN 55427

When it’s time to update your will, you don’t have to start from scratch. You can use a codicil, an addition or supplement that explains or modifies your existing will.

“I give, devise, and bequeath $ ___________ to the National Ataxia Foundation, 600 Highway 169 South, Suite 1725, Minneapolis, MN 55426, for its charitable uses and purposes.

In all other respects I ratify and confirm all of the provision of my said last Will and Testament dated on the _________ day of ______________, 20__.

IN WITNESS WHEREOF, I sign, publish and declare this instrument to be a Codicil to my last Will and Testament in the presence of the persons witnessing said Codicil at my request this _____ day of ___________, 20__.

_________________________ residing at __________________________

(name)

Witnesses

_________________________ residing at __________________________

(name)

_________________________ residing at __________________________

(name)”

——————-

Please note: The codicil, to be valid, must be signed in the presence of witnesses, and the original placed with your other valuable papers. A copy can go to your lawyer and a copy to NAF.

——————-

Legal name: National Ataxia Foundation

Address: 600 Highway 169 South, Suite 1725, Minneapolis, MN 55426

Federal Tax ID number: 41-0832903

* Please note our mailing address is: 7701 Golden Valley Road, PO Box 27986, Golden Valley, MN 55427

In your work as an advisor, you value professionalism, integrity and honesty, taking the utmost care when serving your clients.

As a nonprofit organization, we share your values and take the same care when it comes to helping our donors plan charitable gifts.

We believe that charitable planning is a process that ideally involves the donor, professional advisors, and our gift planning staff — all working together to arrange the best gift possible. Our development team is well-trained and skilled in the application of all vehicles of strategic philanthropy.

——————-

Legal name: National Ataxia Foundation

Address: 600 Highway 169 South, Suite 1725, Minneapolis, MN 55426

Federal Tax ID number: 41-0832903

* Please note our mailing address is: 7701 Golden Valley Road, PO Box 27986, Golden Valley, MN 55427

The content found on this site is general in nature and intended to be used for informational purposes only. It should not be relied upon as legal, tax, accounting or other professional advice. To determine how a gift or estate planning decision might affect your particular circumstances, it is expressly recommended that you consult an attorney, financial advisor or other qualified professional.

Our generous donors help us fund promising Ataxia research and offer support services to people with Ataxia. Your gift today will help us continue to deliver on our mission to improve the lives of persons affected by Ataxia.

Join for FREE today! Become a part of the community that is working together to find a cure. As a member you will receive access to the latest Ataxia news with our e-newsletter and Generations publication.